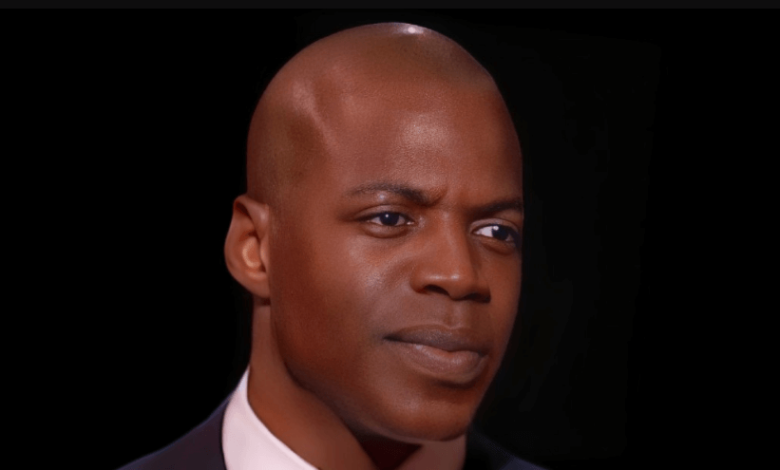

Toor Net Worth: Entrepreneur’s Wealth

Toor’s net worth serves as a testament to his strategic acumen in navigating the complexities of modern entrepreneurship. His diverse portfolio, which includes stakes in innovative technology startups, highlights a deliberate approach to wealth accumulation that prioritizes sustainable practices and disruptive strategies. However, the nuances of his financial journey reveal more than just numbers; they illustrate a broader narrative of industry influence and market dynamics. Understanding the intricacies of Toor’s ventures raises important questions about the future of entrepreneurship and the evolving landscape of wealth creation. What might this mean for aspiring entrepreneurs?

Overview of Toor’s Wealth

Toor’s wealth, characterized by a diverse portfolio of assets and investments, reflects a strategic approach to financial growth and sustainability.

This wealth accumulation is not merely a result of fortunate circumstances but rather a calculated endeavor to enhance Toor’s assets through various channels.

Key Ventures and Investments

Exploring key ventures and investments reveals the strategic foundations that underpin Toor’s financial success and market influence.

Notable contributions include:

- Significant investments in emerging technology startups within the venture capital landscape.

- Establishing partnerships that enhance the startup ecosystem.

- Diversifying portfolios to ensure resilience and growth.

These elements highlight Toor’s commitment to fostering innovation and financial stability in an ever-evolving market.

Innovative Strategies for Success

Building on the foundation of strategic investments, innovative strategies play a pivotal role in driving Toor’s ongoing success and adaptability in a competitive landscape.

By embracing disruptive innovation, Toor has redefined industry standards, while strategic partnerships amplify growth potential.

These approaches not only enhance market positioning but also foster an environment conducive to creativity, ensuring sustained relevance in a rapidly evolving marketplace.

Impact of Market Trends

Market trends significantly influence the valuation of Toor, as economic factors dictate overall demand and investment potential.

Additionally, shifts within the industry create new opportunities while altering the competitive landscape, necessitating adaptive strategies for sustained growth.

Understanding these dynamics is crucial for evaluating Toor’s long-term financial prospects.

See also: Bethany Joy Lenz Net Worth: The Actress’s Financial Journey

Economic Influences on Valuation

Analyzing the interplay between economic conditions and investor sentiment reveals significant insights into how market trends influence the valuation of Toor and similar enterprises.

Key economic factors impacting valuation metrics include:

- Interest rates affecting borrowing costs.

- Inflation trends influencing purchasing power.

- Market volatility shaping investor confidence.

Understanding these elements is crucial for gauging the true worth of businesses in fluctuating economic landscapes.

Industry Shifts and Opportunities

How are evolving consumer preferences and technological advancements reshaping the landscape of industries related to Toor, creating both challenges and new growth opportunities?

Market disruption is inevitable as emerging technologies redefine operational paradigms.

Businesses must adapt to shifting demands, leveraging these innovations to enhance customer experiences.

This transition presents a unique opportunity for Toor to capitalize on market trends while navigating potential obstacles effectively.

Competitive Landscape Dynamics

As consumer preferences continue to shift and technology advances, the competitive landscape surrounding Toor is evolving. This evolution prompts businesses to reassess their strategies and positioning to remain relevant in an increasingly dynamic market.

Key factors influencing market competition include:

- Rapid technological innovation

- Shifts in consumer demand

- Emerging market players

These elements necessitate effective strategic positioning for Toor to capitalize on opportunities and mitigate risks.

Philanthropic Endeavors

Toor has actively engaged in various philanthropic endeavors, focusing on initiatives that support education, healthcare, and community development.

His charitable initiatives emphasize community engagement, fostering sustainable growth and empowerment.

Personal Life and Financial Management

The balance between personal life and financial management plays a significant role in shaping Toor’s overall success and influence, reflecting his ability to maintain stability while pursuing ambitious professional goals.

Key aspects include:

- Consistent financial habits that promote savings and investments.

- Prioritizing personal growth through continuous learning.

- Maintaining healthy relationships that support a balanced lifestyle.

These elements underscore his effective approach to wealth management.

Future Financial Outlook

The future financial outlook for Toor presents a range of investment opportunities driven by emerging market trends.

Analyzing these trends will be essential for identifying sectors poised for growth, enabling strategic capital allocation.

As economic conditions evolve, understanding these dynamics will be crucial for sustaining and enhancing Toor’s net worth.

Investment Opportunities Ahead

Numerous investment opportunities are emerging as the market evolves, driven by technological advancements and shifting consumer preferences.

Investors should consider:

- Emerging technologies: Innovations in AI, blockchain, and biotechnology.

- Sustainable investments: Focus on companies prioritizing eco-friendly practices.

- Impact investing: Aligning financial goals with social and environmental outcomes.

These avenues not only promise potential returns but also contribute to a more sustainable future, appealing to those seeking financial freedom.

Market Trends Analysis

Analyzing market trends reveals a complex landscape shaped by technological advancements, regulatory changes, and evolving consumer behaviors, all of which are pivotal in forecasting future financial outcomes.

Current market sentiment indicates a cautious optimism among investors, influenced by shifting investor behavior towards sustainable and innovative sectors.

Understanding these dynamics is essential for navigating the financial landscape and identifying lucrative opportunities for growth.

Conclusion

In summation, Toor’s strategic accumulation of wealth serves as a testament to the potency of informed investment choices in a volatile market.

By navigating the currents of innovation and sustainability, a resilient financial foundation emerges, akin to a lighthouse guiding others through turbulent waters.

This approach not only solidifies Toor’s standing as a significant industry player but also heralds a future ripe with potential, underscoring the importance of adaptability and foresight in entrepreneurial endeavors.