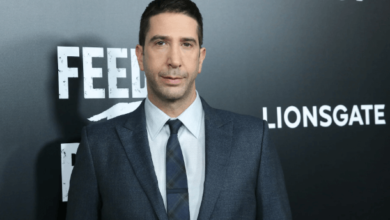

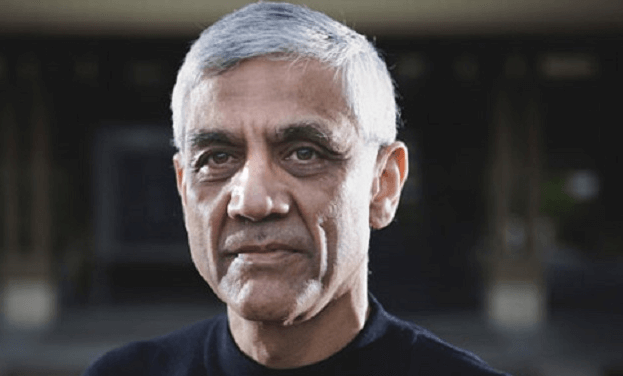

Vinod Khosla Net Worth: Venture Capitalist’s Wealth

Vinod Khosla, co-founder of Sun Microsystems and founder of Khosla Ventures, has established himself as a formidable figure in the realm of venture capitalism, amassing considerable wealth through a keen eye for promising technologies. His investment strategies, particularly in sectors such as renewable energy and healthcare, underscore his commitment to innovation and his influence within the industry. However, the factors contributing to his significant net worth extend beyond mere financial acumen; they reflect a broader narrative of risk-taking and visionary foresight that invites further exploration into his journey and impact.

Early Life and Education

Vinod Khosla was born on September 28, 1955, in Pune, India, where he grew up in a family that valued education and innovation, laying the groundwork for his future entrepreneurial success.

His educational achievements include a Bachelor’s degree in Electrical Engineering from the Indian Institute of Technology (IIT) and an MBA from Stanford University, both of which significantly shaped his analytical skills and entrepreneurial mindset.

Career at Sun Microsystems

Vinod Khosla’s tenure at Sun Microsystems marks a significant period characterized by substantial growth and innovation within the company.

His contributions played a crucial role in the development of key technologies that would shape the future of computing.

Analyzing his impact reveals insights into both the strategic direction of Sun Microsystems and the broader tech industry during that era.

Founding and Growth

The founding and growth of Sun Microsystems marked a significant chapter in the technology industry, with Vinod Khosla playing a pivotal role in shaping the company’s trajectory and innovative culture.

His entrepreneurial mindset enabled the organization to adapt to emerging market trends, fostering an environment that encouraged creativity and collaboration.

Khosla’s contributions were instrumental in establishing Sun as a leader in the tech landscape.

Key Innovations and Contributions

During his tenure at Sun Microsystems, Khosla was instrumental in driving key innovations that not only advanced the company’s technological capabilities but also reshaped the broader landscape of computing.

His focus on disruptive technologies and sustainable innovations laid the groundwork for breakthroughs in network computing and enterprise solutions, empowering businesses to operate more efficiently and adapt to the rapidly evolving digital environment.

See also: Bibi the Monkey Net Worth: How Much Is This Viral Sensation Worth?

Founding Khosla Ventures

Vinod Khosla founded Khosla Ventures in 2004, aiming to support innovative technology startups.

The firm’s early investment strategies focused on fostering disruptive ideas, which has resulted in a diverse portfolio of successful companies.

This approach has significantly impacted the startup ecosystem, enabling new ventures to thrive in competitive markets.

Early Investment Strategies

Khosla Ventures was established with a focus on identifying and nurturing innovative technology startups, leveraging strategic insights to drive early-stage investment success.

The firm employs angel investing techniques, emphasizing thorough risk assessment to discern high-potential opportunities.

This disciplined approach enables Khosla Ventures to support visionary entrepreneurs, fostering an ecosystem where groundbreaking ideas can flourish, ultimately contributing to technological advancement and economic growth.

Portfolio Companies Overview

The portfolio of Khosla Ventures showcases a diverse array of companies that span various sectors, reflecting the firm’s commitment to fostering innovation and technological advancement.

This portfolio diversity not only highlights Khosla’s strategic foresight but also aligns with current investment trends, emphasizing sustainability and technology.

Impact on Startups

Founding Khosla Ventures has significantly influenced the startup ecosystem by providing essential funding and strategic guidance to early-stage companies, fostering innovation across various industries. The firm’s approach to venture funding emphasizes transformative technologies, encouraging entrepreneur independence and creativity.

| Aspect | Impact on Startups | Examples |

|---|---|---|

| Funding | Increased capital | Healthtech, AI |

| Guidance | Strategic support | Business model refinement |

| Innovation Encouragement | Diverse sectors | Renewable energy |

Key Investments and Successes

Key investments by Vinod Khosla have played a pivotal role in shaping the landscape of technology and innovation, particularly through his early backing of transformative companies in sectors such as renewable energy, healthcare, and artificial intelligence.

These strategic choices have not only influenced investment trends but also strengthened startup ecosystems, fostering an environment where groundbreaking ideas can flourish and drive substantial economic growth.

Sources of Net Worth

Vinod Khosla’s net worth is primarily derived from his successful venture capital investments, particularly through his firm Khosla Ventures, which focuses on disruptive technologies and innovative startups.

His wealth accumulation can be attributed to effective investment strategies, including:

- Early-stage funding in promising tech companies.

- Strategic partnerships with industry leaders.

- Diversification across various sectors.

These approaches have solidified his financial success in the venture capital landscape.

Philanthropic Efforts and Impact

Consistently demonstrating a commitment to social change, Khosla has engaged in various philanthropic initiatives that focus on education, health care, and environmental sustainability.

His efforts are aimed at creating substantial social impact, reflecting a belief that innovation can address pressing global challenges.

Legacy in Venture Capitalism

Khosla’s legacy in venture capitalism is marked by a strategic focus on disruptive technologies and a commitment to fostering innovation across diverse industries. His investment philosophies have shaped venture capital trends, impacting future entrepreneurs and investors alike.

Key aspects of his legacy include:

- Emphasis on sustainability in technology

- Support for groundbreaking healthcare innovations

- Advocacy for diverse startup ecosystems

Conclusion

In the landscape of venture capitalism, Vinod Khosla stands as a towering figure, weaving a narrative of innovation and success.

His strategic investments act as seeds sown in fertile ground, yielding transformative technologies that reshape industries.

The wealth accumulated through these ventures reflects not only financial acumen but also a commitment to fostering groundbreaking advancements.

As Khosla continues to influence the venture capital ecosystem, his legacy blossoms, inspiring future generations to cultivate their own paths in entrepreneurship and innovation.